Check Out Specialist Car Loan Solutions for a Smooth Borrowing Experience

In the realm of monetary purchases, the pursuit for a seamless borrowing experience is commonly demanded yet not easily achieved. Professional car loan services provide a pathway to browse the intricacies of loaning with accuracy and know-how. By aligning with a reliable loan supplier, people can unlock a wide variety of advantages that expand past plain financial purchases. From customized car loan solutions to customized support, the world of expert funding services is a realm worth checking out for those seeking a borrowing journey noted by efficiency and simplicity.

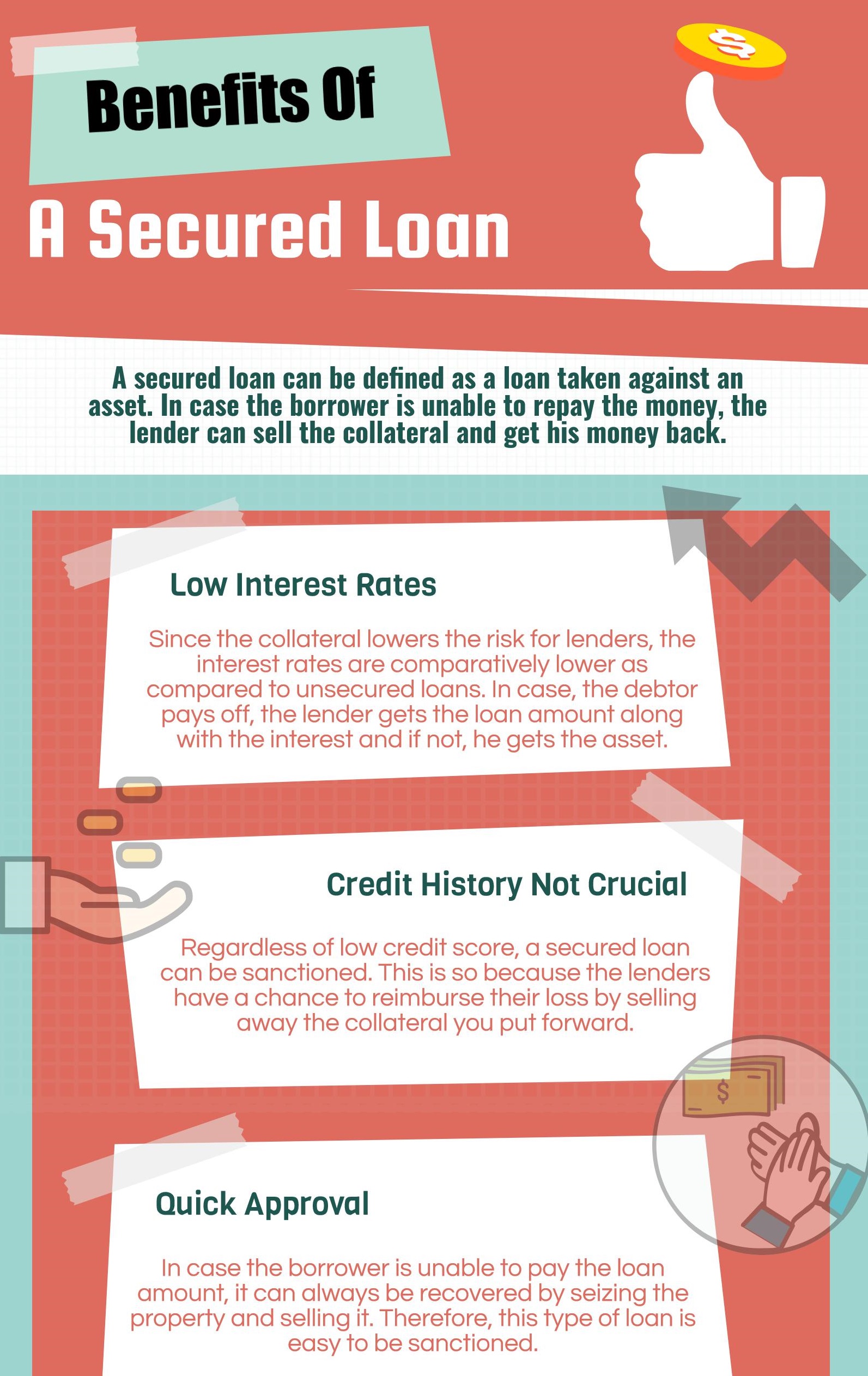

Advantages of Specialist Finance Solutions

When considering monetary options, the advantages of using specialist financing services end up being apparent for individuals and organizations alike. Professional finance services offer proficiency in navigating the facility landscape of borrowing, offering customized options to satisfy details financial needs. One considerable benefit is the access to a wide variety of loan items from numerous lenders, allowing customers to select one of the most ideal option with desirable terms and prices. Moreover, professional lending services usually have developed partnerships with lending institutions, which can lead to faster authorization processes and much better negotiation outcomes for debtors.

Choosing the Right Car Loan Supplier

Having recognized the advantages of expert loan services, the next crucial action is selecting the appropriate funding provider to fulfill your particular financial requirements efficiently. best merchant cash advance. When picking a lending service provider, it is necessary to take into consideration a number of vital variables to make certain a smooth loaning experience

First of all, review the online reputation and credibility of the car loan service provider. Research client testimonials, scores, and reviews to evaluate the complete satisfaction degrees of previous consumers. A reputable loan carrier will certainly have transparent terms, superb client service, and a performance history of integrity.

Secondly, contrast the rate of interest, fees, and repayment terms supplied by different car loan service providers - quick mca funding. Look for a supplier that supplies competitive rates and flexible settlement options tailored to your financial situation

Furthermore, take into consideration the funding application procedure and authorization duration. Select a supplier that offers a structured application procedure with fast approval times to access funds without delay.

Simplifying the Application Refine

To boost effectiveness and benefit for candidates, the financing service provider has actually applied a structured application process. This polished system aims to top merchant cash advance companies streamline the borrowing experience by reducing unneeded documentation and accelerating the authorization procedure. One vital function of this streamlined application procedure is the online platform that allows candidates to submit their information electronically from the comfort of their very own office or homes. By getting rid of the need for in-person brows through to a physical branch, applicants can save time and finish the application at their convenience.

Recognizing Lending Terms

With the structured application process in place to streamline and accelerate the borrowing experience, the next essential action for applicants is obtaining a detailed understanding of the finance terms and conditions. Recognizing the terms and conditions of a loan is crucial to make certain that debtors are mindful of their duties, rights, and the total expense of borrowing. By being educated about the car loan terms and problems, borrowers can make audio monetary decisions and browse the loaning process with self-confidence.

Taking Full Advantage Of Funding Approval Opportunities

Safeguarding authorization for a finance requires a calculated strategy and detailed prep work on the part of the borrower. Furthermore, reducing existing debt and staying clear of taking on brand-new financial debt prior to applying for a lending can demonstrate financial duty and enhance the possibility of authorization.

Furthermore, preparing a comprehensive and realistic budget plan that describes revenue, costs, and the proposed loan settlement plan can display to loan providers that the borrower can handling the additional monetary obligation (best merchant cash advance companies). Giving all necessary documentation immediately and precisely, such as evidence of earnings and employment history, can improve the approval process and instill confidence in the lender

Verdict

To conclude, specialist financing services supply numerous advantages such as skilled assistance, customized car loan choices, and boosted approval chances. By choosing the appropriate lending supplier and recognizing the terms and conditions, customers can streamline the application process and make sure a seamless loaning experience (Financial Assistant). It is necessary to carefully take into consideration all facets of a lending prior to dedicating to guarantee monetary stability and effective payment

Comments on “Encourage Your Financial Trip with Committed Loan Services”